Why you should pay debt before investing

What is a good credit card balance?

February 4, 2018

How to Raise Your Credit Limits

February 18, 2018Why you should pay debt before investing

95% of the wealth is owned by 5% of the people. We’ve all heard the statistics, but do we understand what this means. It’s normal to hear this statistic and automatically think about ways to invest the little money you have and try to multiple your money. However, contrary to what you might believe, it’s not as simple as that. Let’s take a look at a few things first:

The rich understand debt

The rich understand that you need leverage in over to win big. Leverage basically means that they have trust in banks, so that they can borrow large sums of money to make more money. The only way this can happen, is if they not only have qualifying credit, but can prove that once they borrow the money it can produce income.

Try walking into a bank account and asking them for money to buy a stock. They will most likely escort you out of the building in the most formal way possible. Now, try asking to borrow money to buy a house. Why is it easier for them to lend you money to buy a house than it is for them to allow you to borrow money for a stock? The answer is because a stock has high volatility, which is a word used in asset classes to say its high risk. They’ll loan you the money to buy a house because it’s something real, physical, and if you don’t pay they can easily take it back, even if you owe $400 on the loan. Not only does the house pay them interest over time, but also the property is appreciating and usually on a 30 year mortgage, you usually end up paying triple the price of the loan once the loan is amortized (paid off).

The rich hate fees, and interest

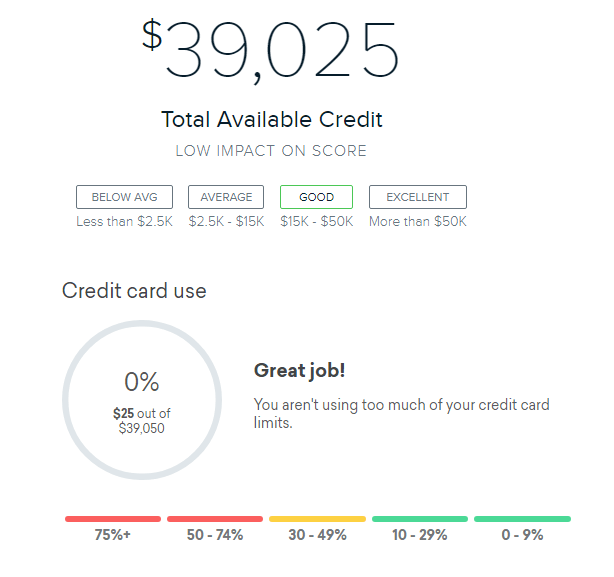

The average credit card has an interest rate of about 19%. Although this annual percentage is yearly, and you can calculate it by taking the total debt, multiplying it by .19, and then diving it by 12 to see how much you are paying interest every month if you only make the minimum payments. Take a $2000 dollar vacation, put it on your Discover card, and while your minimum payment might be $30-40, $20 will go only to interest. The rich understand this, so they also understand the cost to items. While most households think about purchases as a monthly minimum payment, the rich spend only what they can afford, because they have the cash to pay off the balance in full once the statement comes in.

Typical investments only pay 7-10%

Here’s the real truth. The wealthy only earn about 7-10% of their money yearly. If you just understood what I said, and you take a look at the previous paragraph, the average interest rate on a credit card is 19%. Which means, the credit card companies are making more money than the average investor. If you’re looking to invest, and you can only get 7-10% interest, it would be in your best interest to pay down credit card debt to not pay 19%.

Cash is king

If I told you I had a 20 million dollar boat, and I know a person who inherited this boat, and he’s willing to sell it at $34,000, would you be able to buy it? Cash is the most important thing to have access to, and the reason why most individuals can’t invest is because they have high monthly expenses, houses, cars, and debt payments. Imagine your bank having more money coming in, than out. You can set aside money in case of emergencies, and never feel out of control.

Once you understand these principles, you can make the right decision and start the beginning of a new financial future. In the meantime, build credit, and you’ll be on your way to prosperity.