This may seem unfair, but your credit score is based on a number of factors. They look at your payment history for every listing on your credit report, the total amount of outstanding debt you have, and the length of your credit history. They also check to see if you have had any derogatory credit information, such as bankruptcies, charge-offs, and collections. And finally, they calculate how much credit you have used in comparison to how much credit you have available.

The Fair Credit Reporting Act has made it possible for you to get a free copy of your credit report every twelve months from all three major credit bureaus. Unfortunately, your credit score is not usually included in this free information. But for additional five or ten dollars, you can get your credit score included.

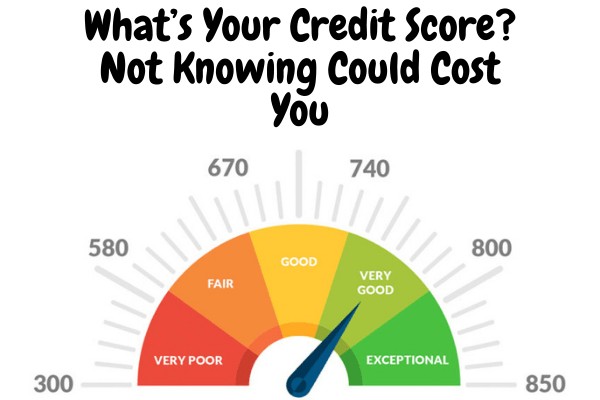

Knowing your count can help you get a better picture of what the information on your credit report means. For example, a count of 720 or higher will get you the best rates on home loans. And a credit score of below 500 will cost you hundreds, perhaps thousands of dollars in high interest rates, if you can qualify for a loan at all.

If your credit score is very low and you do not have any significant derogatory entries on your credit report, it’s time to take a good look at that report and find any inaccuracies. Be sure that all the debt you have paid off shows up as a zero balance, and double-check your available lines of credit