What is a Credit Score

What Is a Cash Advance, and Is It Worth It?

March 13, 2021

What Is a Derogatory Public Record?

March 13, 2021A credit score is basically a number that all third parties, particularly lenders, use to evaluate the risk of lending you any specific amount of money. More often than not, it’s the way credit card companies, banks, and some institutions assess your capability to pay off your debts.

If your score is high, it shows that your historical behavior and current financial circumstances show your ability and willingness to pay off the loans you’ve been approved for.

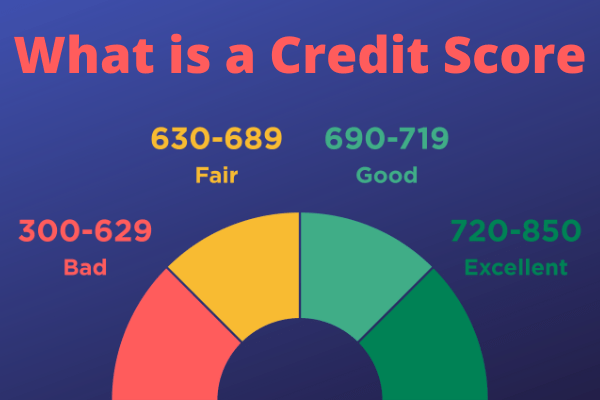

In the US, the credit scoring system you’ll hear is the FICO score, which is the score used by big credit agencies to know your creditworthiness. If your FICO score is between 300 and 850, it means that you have a good credit score.

In terms of credit, lenders sometimes refer to this as Credit Quality or Credit Level, such as excellent, good, fair, average or poor with every category referring a wide range of FICO scores.

Credit Score And Things That Affect It

While all credit scoring systems vary from one another, there is some factor that may affect your score. Such factors include credit inquiries, number of accounts, available credit, payment history, balances on your active credit, and so on.

Every factor can affect your credit score in a different way. If you like to keep your number high, it’s essential to stay on top of your paying bills, limiting inquiries, and using your approved credits.

However, if you’re in the market to buy a loan or house, there’s a yearly 45-day grace period in which every credit inquiry is considered a cumulative inquiry. In short, once you go to 2-3 lenders within the 45-day period to get the best terms and rate available for loans, it just counts as a single inquiry. It means they’re not counted against you and won’t affect your credit score.

Why Credit Score Is Important?

Generally, people with high credit scores get more favorable credit terms that may translate into low payments and less interest rate throughout your account’s life. Take note that everybody’s credit and financial situation is different. Various lenders may have varying criteria in terms of granting credit, which can include information like your income.

The kinds of credit scores used by creditors and lenders may differ based on their industry. For instance, if you’re purchasing a car, a car lender could use credit scores that place more emphasis on your payment history in terms of car loans.

A credit score may differ in accordance with the used scoring model and this may differ based on which credit bureau furnishes credit reports used for the data. It’s because not every creditor report to all credit bureaus.

All in all, every lender has different standards when it comes to credit scores and your experience may also vary. Even if your credit score won’t take your monthly income into account, your preferred lenders will. So, regardless of how great your credit scores are, lenders won’t approve you if they feel that there are risks, like your inability to make repayments.