What Is a Cash Advance, and Is It Worth It?

What is a Bad Credit Score?

March 13, 2021

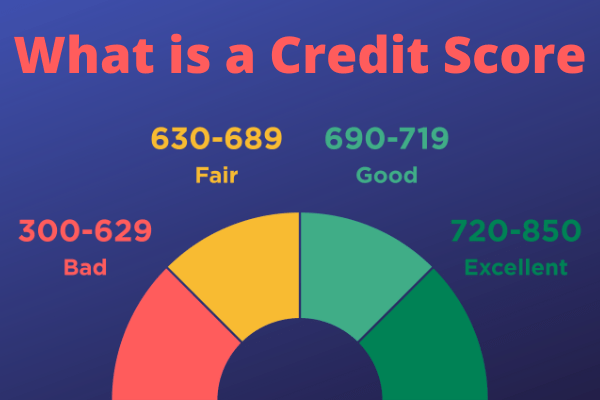

What is a Credit Score

March 13, 2021What Is a Cash Advance, and Is It Worth It?

A cash advance is a withdrawal that you can arrange with the credit card issuer that lets you get certain amounts of money when you need them. There are so many things that can happen and there are times when you need instant access to cash even on short notice.

The idea might sound convenient and great but this is only applicable in certain cases. The involved risks are quite high, however, and it is important to know more about them first before you even think of getting one from your credit card.

What is a Cash Advance?

Just so you know, credit cards don’t function the same way as debit cards. Once you connect your debit card to your bank account, all you have to do is get your money anytime you want, paying only for the bank or ATM fees.

On the other hand, if you will withdraw from your credit card account, you will technically take out a cash advance. This is somewhat different from your usual withdrawal.

A cash advance is like a loan that is similarly subject to interest rates and fees. Every time you take out cash advances, it is similar to buying the convenience that cash has to offer.

You might need to take out a cash advance for those instances when it is not possible for you to make a purchase otherwise. As expected, there are always those old-style businesses, cash bars, and occasional food trucks that don’t accept anything else other than cash. These are cases where cash withdrawals can be quite tempting.

There are also non-essential products that you can purchase with your cash advance. However, while it is nice to bite into the greasy burger, it might not taste that good once you realize that you will be paying interest on the cash that you took out just to buy it.

If your card has been set up with a pin, it is possible to take out your cash advance from any ATM. If not, you can simply stop in your bank or any bank-affiliated located to take out a cash advance.

Is Your Credit Score Affected by Cash Advances?

The mere act of taking out cash advances won’t have a direct effect on your credit score. But, there are two ways that it might indirectly impact your score.

For one, this can increase your credit utilization rate. It is recommended that you stay at or lower than 30% credit utilization. You might notice your credit score taking a dip if your cash advances have caused your credit utilization rate to go beyond that threshold.

The second is that the high-interest rates and fees might affect your ability to make on-time and consistent payments. A late or missed payment might have devastating impacts on your credit score. This is why it is important to ensure that you have a good repayment plan in place once you take out a cash advance.

While a cash advance can be very convenient, it still carries a high price tag. If you ever need cash, you might want to consider other cheaper options to get your hands on it anytime the need arises.