What are the Three Credit Bureaus?

What Are Money Orders and How Do They Work?

March 12, 2021

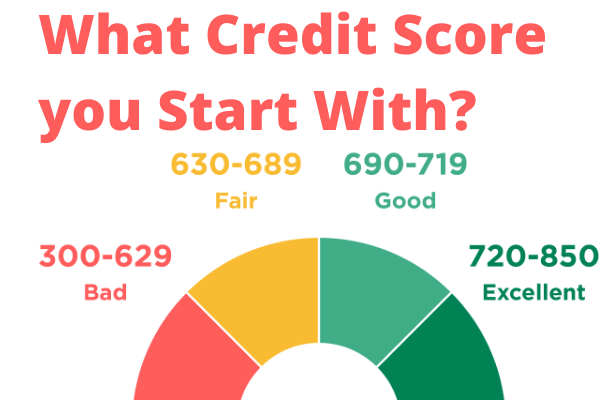

What Credit Score Do You Start With?

March 12, 2021Three Major Credit Bureaus?

Your financial life will never be complete without your credit score. Your credit score is also managed and tracked by the three major credit bureaus – Equifax, Experian, and TransUnion.

Equifax

With operations in 11 countries, Equifax is the multinational credit reporting agency that tracks and monitors consumer data on over 222 million consumers in the US. Equifax provides a plethora of consumer and business credit products. Their primary consumer products are comprehensive solution for credit monitoring and a credit lock product.

The credit bureau is probably infamous for the 2017 data breach that affected around 147 million consumers all over the 50 states. It led to over $575 million-worth settlement, including civil penalties and free identity theft protection and credit monitoring for fee to affected consumers.

Equifax credit reports support major industries such as insurance companies, financial firms, government agencies, utilities, healthcare providers, retailers, and other types of businesses.

Established in 1899, the main headquarters of Equifax is located in Atlanta with its stock listed on New York Stock Exchange. The credit bureau is also part of the S&P 500.

Experian

Experian is the international credit reporting agency that has details on approximately 40 million businesses and 220 million individuals in the US. Aside from credit scoring information, Experian also tracks vehicle records, household demographics, and other sets of large data.

The credit bureau provides access to credit scores and credit reports for free through the app and website of Experian. This provides extensive resources for credit education to help consumers boost their credit.

Experian Boost is one of Experian’s unique feature, a product that lets you add information from phone or utility bills as part of the positive credit history that can make your FICO credit score better in an instant.

Despite the generally positive reputation of Experian, the credit bureau was affected by negative press back in 2015 because of the role it played in the data breach that potentially exposed the details of 15 million consumers. The Consumer Financial Protection Bureau also fined them in 2017 because of providing consumers with misleading credit score details.

TransUnion

TransUnion is a global credit and data reporting company that has information on a billion in more than countries. The data of TransUnion covers more than 200 million US consumers and provides credit improvement resources as a way of improving your credit score and history.

TransUnion is a source of data for different credit scoring applications such as Credit Karma and budgeting app Mint’s credit score section. Similar to its two competitors above, TransUnion provides credit reports or credit scores to their customers in financial sector, landlords, employers, and those who wish to access credit information.

It is free to unfreeze and freeze your credit with TransUnion. You can also sign up to their paid services offering more options and features to manage and lock your credit details. TransUnion has a positive information in general although it also faces challenges, especially regarding its transparency on the way they charge for their consumer products.