Understanding How Your Credit Score Is Calculated

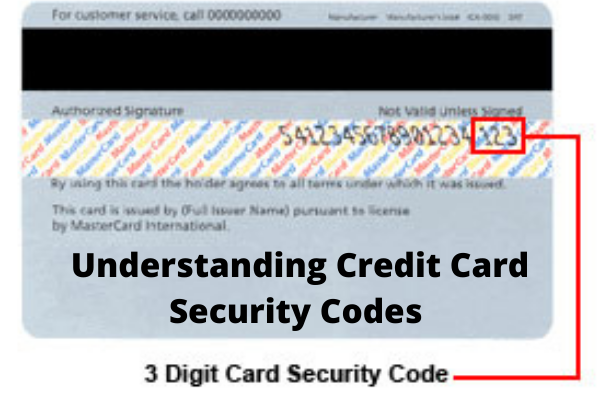

Understanding Credit Card Security Codes

March 11, 2021

Voluntary Repossession and How It Affects Credit

March 12, 2021Understanding How Your Credit Score Is Calculated

Understanding How Your Credit Score Is Calculated:

A lot of people are actually surprised to know that they don’t only have a single credit score. There are many reasons why your credit score can vary, such as the data that served as the basis of the score, the company that provides the score, as well as the specific method used to calculate the score. In this article, we will you in understanding how your credit score is calculated.

Your credit score is among the most critical measures that determine whether you are creditworthy or not. For your FICO score, this is a three-digit number that usually ranges from 300 to 850 that is based on the metrics that Fair Isaac Corporation has developed.

A higher score makes you less risky in the eyes of the lenders. Through understanding how your credit score is calculated, you will be able to take the necessary steps to make it better.

Below are the factors considered by credit scoring models when calculating your credit score:

Payment History

Your payment history makes up 35 percent of your credit score. It shows if you are on time with your payments, if there are any recent payments missed, the number of days it takes to pay your bills beyond the due date, and how frequently you miss your payments. Your score will be higher if your on-time payments are also of higher proportion. Your score will suffer from a negative impact whenever you miss a payment.

Amount You Owe

The amount that you owe on credit cards and loans makes up about 30% of your credit score. It is based on your total owed amount, the types and number of accounts that you have, as well as the proportion of the money you owe compare to your available credit.

Maxed out credit cards and high balances can lower your credit score yet you can raise it with smaller balances provided you pay right on time. There might be a temporary drop in your score if you have new loans that have little payment history. However, loans that can be paid off soon can help increase it since they show a good payment history.

Length of Credit History

Your length of credit history makes up 15% of your credit score. Your score will be higher if you have a longer history of making on-time payments. You might think that is wise to not just apply for credit and carry debt but it might end up hurting your score when lenders don’t have any credit history to check and go through.

Types of Accounts

About 10% of your credit score is made up of the specific types of accounts that you have. Mixing several accounts such as credit and retail cards, home loans, and installment loans can make your score better.

Recent Credit Activity

The remaining 10% is made up of your recent credit activity. If you applied to open accounts or you opened several accounts recently, it may lower your credit score as it indicates possible financial issues. But, if you had the same credit cards or loans for quite some time and you pay them right away even after troubles with payment, your score can increase over time.