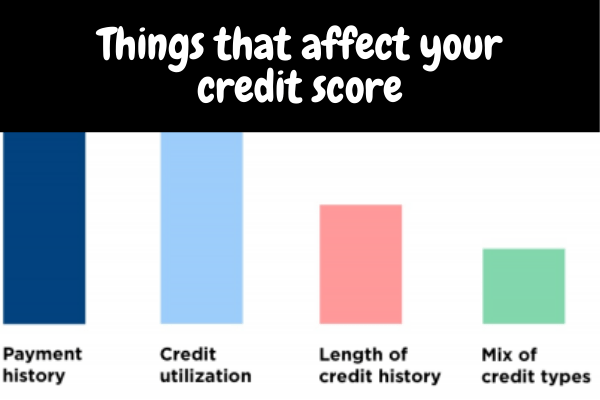

Things that affect your credit score

How to Dispute an Error on Credit Report

July 2, 2016

How Medical Debt Can Impact Your Credit Score

July 7, 2016Things that affect your credit score

Learning the rules of credit isn’t always as straightforward as you might think. Sometimes, doing something you might think would be great for your credit score can actually have an unintentional negative impact.

The first step in understanding what affects your score is to know where you stand by pulling your free credit report once annually from each of the credit bureaus from AnnualCreditReport.com. If you’d like to monitor your credit score on a monthly basis, you can also get your free Credit Report Card.

Late Library Books

You might not think that the overdue copy of “50 Shades of Grey” that you checked out of the library would have an impact on your credit score, but that bill could be sent to a collections agency.

“Collections that can seriously hurt your score can arise from parking tickets and library fines, as much as from medical bills and credit card charge offs — with the impact to your score being similar,” says Barry Paperno, a credit industry veteran and Credit.com’s Community Director.

So, get those books back when they’re due or the librarian won’t be the only one coming after you.

Divorce

Getting divorced involves dividing your assets as well as your debts, but just because your ex takes on the mortgage payments doesn’t mean that you’re off the hook.

“The account remains on their credit report and remains their responsibility until it is paid and closed. And even then it won’t be removed from their credit history,” says Gerri Detweiler, Credit.com’s Director of Consumer Education. “Plus if your ex declares bankruptcy, creditors will come after you for balances on any joint accounts.”

Closing an account

Many people think that getting rid of a credit card that they don’t want, need or actually use is a good idea since it will show they’re not credit-dependent. However, this can be a bad idea for two important reasons.

“This can (but will not always) raise your utilization percentage, and a closed account is often purged from your credit report sooner (7-10 years) than an open one (remains indefinitely) causing you to lose all of the positive credit history associated with the account,” Paperno says.

One important note on closed accounts that might surprise you — it doesn’t matter if you close the account or if the issuer closes it, the effect on your credit score will be the same.