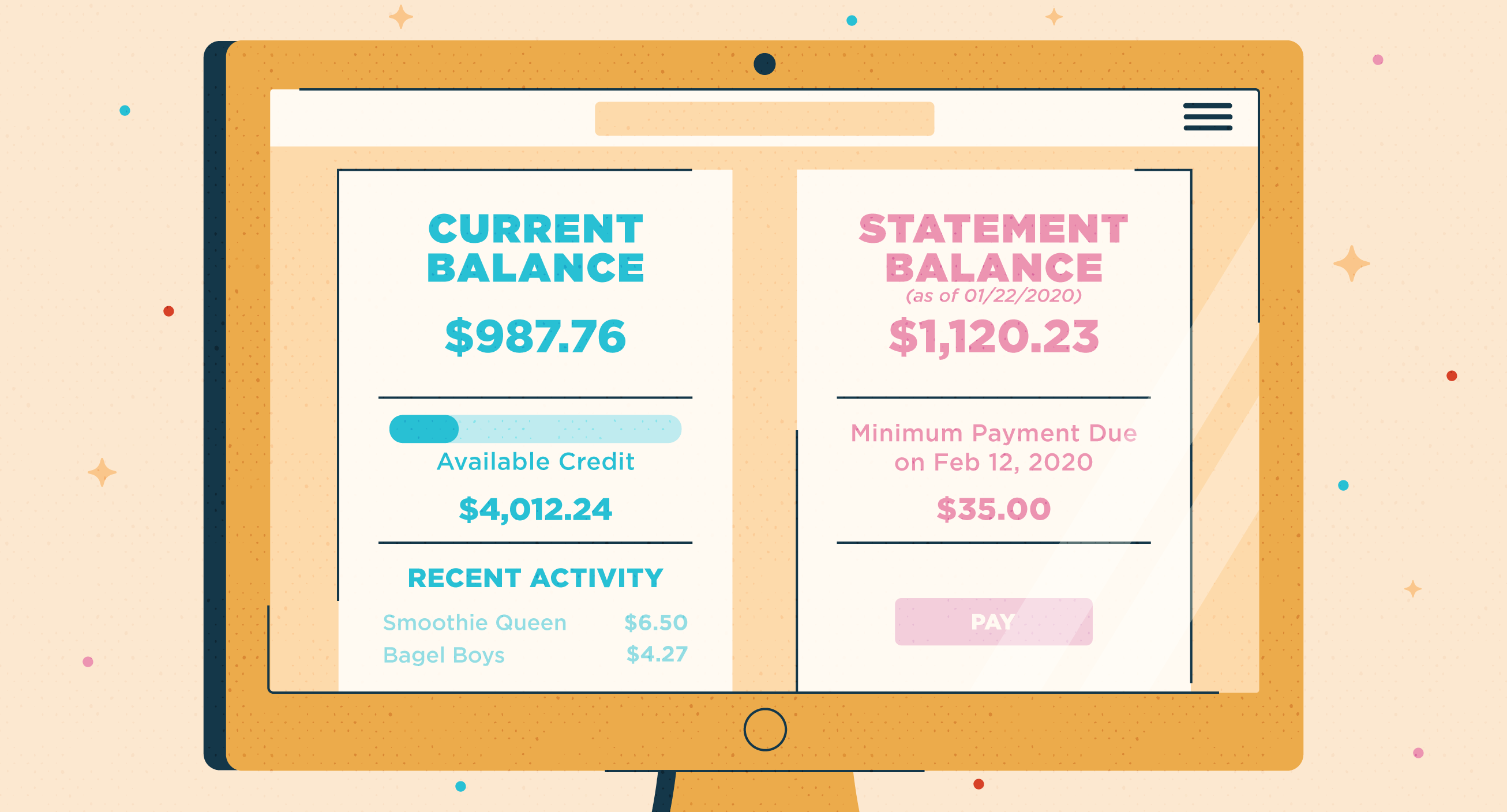

Statement Balance vs. Current Balance

You have probably seen the terms “statement balance” and “current balance” on your credit card statement. Sometimes, the two amounts are the same. Other times, they are different. But even if the amounts of these terms happen to be the same on a certain month, these terms are completely different from each other. Read below to know all about Statement Balance vs. Current Balance.

What is a Current Balance?

Also known as outstanding balance, the current balance pertains to the total amount that the cardholder owes on his credit card. This amount can change every day. It may increase or drop depending on your purchases, fees, credits, interest charges and payments received. When you check your credit card account, you will see the amount that you owe on the card and your available credit.

Since credit cards are not updated in real-time, it’s not the current balance that appears on the credit report. It’s the statement balance. You can pay the current balance all at once, but you still need to pay the interest charges. Paying the current balance, however, could reduce your credit utilization ratio. If that happens, your credit score will improve.

What’s a Statement Balance?

The statement balance reflects the main balance on the credit card. It’s the total amount of purchases, fees, unpaid balances and interest charges that appeared on the account during the card’s billing cycle. The statement balance includes both the expenses and payments for your current billing cycle.

Which Balance to Pay

When deciding which balance to settle, consider your billing cycle. This period is usually thirty days. You’re also given a grace period to settle your statement balance. During this period, the amount that you owe won’t accrue interest. The grace period varies from one service provider to the next.

The current balance on your card will be higher than the statement balance if you have made purchases at the end of your statement cycle. But this won’t be a problem if you pay your bills on time. You can use automatic payments to avoid late or missed payments. This can also help improve your credit score. If you want to use automatic payments, just make sure that your checking account has enough funds so that you can avoid late and overdraft fees.

How the Balances Affect Credit Scores

The current balance and statement balance can affect credit scores. Your credit rating drops if you fail to pay your bills on time. The credit card company sends an update to the major credit bureaus each month regarding the cardholder’s current balance and statement balance. This information can affect your credit score and credit utilization ratio. In other words, these balances can either harm or improve your credit score. To maintain your credit score, rating and utilization ratio, try to keep your card’s statement balance within thirty percent of the credit limit. And when paying your balances, try to pay them in full. Pay off cash advances at the soonest time possible to prevent your card from accruing interest.