The Value of Credit Scores

Credit scores are a valuable tool for lenders. Because banks and other lending institutions receive numerous loan requests on a daily basis, it is challenging determining which applicants should get approved.

Lenders have many methods for judging a person’s creditworthiness. To speed up the process, several lenders begin by reviewing a credit score. To separate the good applicants from the bad, they establish a minimum credit score requirement. If your score falls below this requirement, it’s an immediate credit denial.

Calculating Credit Score:

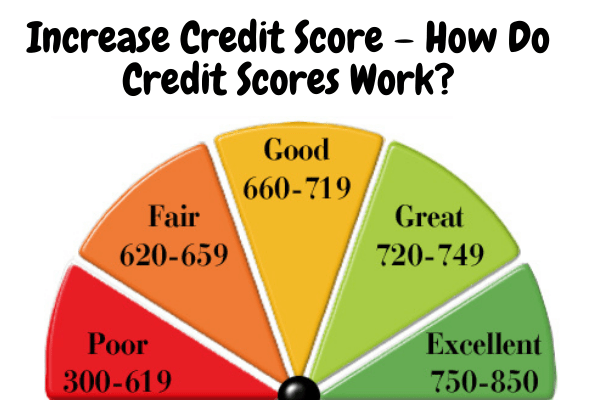

Many factors play a role in credit scoring. Scores are between 300 and 850. The higher the score, the better the credit. Although having perfect credit is very hard, it is possible to maintain a good credit rating. This typically consists of scores above 680. Those who fall into this category usually qualify for prime rates on home loans, auto loans, and credit cards.

When calculating credit scores, several factors are taken into account. For example, payment history, outstanding debt, length of credit, and inquiries. Payment history and outstanding debts contributes largely to credit scoring.

Payment history with creditors is important because future lenders are curious as to whether you submit payments on time, or have a habit of being late. Moreover, having too much debt will have a negative effect on your score.

Raising Credit Scores:

Little things can quickly boost your credit score. For starters, begin establishing a good payment history with creditors. Because payment history contributes to 35% of credit scoring, paying creditors on time is a great way to increase your score. Furthermore, reduce your outstanding debts. Debt contributes to 30% of scoring. Thus, the more debt you have, the lower your score. Keeping credit cards at their maximum limit is damaging. If possible, keep cards at about 25% of their maximum limit.