How credit works

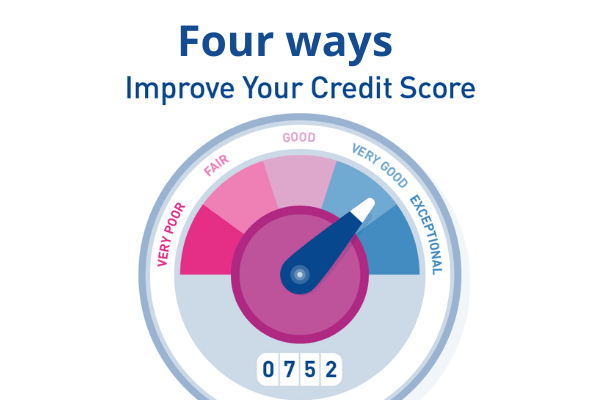

Four ways to improve your credit score

April 3, 2016

Protecting your Customer Credit Card Information

April 11, 2016What is credit?

So you want to know how credit works. Put simply, credit is borrowing money and paying it back at a later date, usually monthly. It can take many forms, including a credit card, loan or a bank overdraft.

The details you give on the application, such as your income and how long you’ve lived at your address, together with information on your credit file – such as how you’ve paid credit back before – helps lenders decide whether or not to lend you credit.

What is a representative example?

When you apply for credit, you’ll see something called a representative example.

The rate shown is what a minimum of 51% of customers will pay on the credit card or loan and also shows what fees are payable (not default fees). It needs to state if an APR or interest rate is fixed or variable and give you a good idea of how much the credit card will cost you. A representative example helps you compare credit and come to a decision about whether a particular credit facility is right for you.

How credit works ?

How to build your credit file

The better your credit file is, the easier it’ll be to get credit. The simplest way to build your credit file is to pay your credit cards, loans and mortgage on time, keep within agreed credit limits and pay at least the minimum payment.

How you make your payments and how much you pay is reported every month on your credit file.

Lenders look at all these factors when you apply to borrow from them. They’ll also take into account how much credit you owe compared to your income to form an overall picture of your creditworthiness.

Your credit file also shows where you’ve been registered on the voters’ roll, your address history and if you’ve ever had any county court judgements or bankruptcies held against you. If you believe any of the information held about you might be wrong, get in touch with the lender who’s reported it and ask them to investigate so it can be updated if needs be.

Managing credit

Once you’ve been given credit, it’s really important you manage it properly. That means making your payments on time and not borrowing more than you can handle. Don’t go over your credit limit either and only take out credit when you really need it. Sometimes borrowing can also get out of hand. So look after that too.