Holiday debt piles onto already high credit card balances

The best time to refinance your auto loan

December 30, 2017

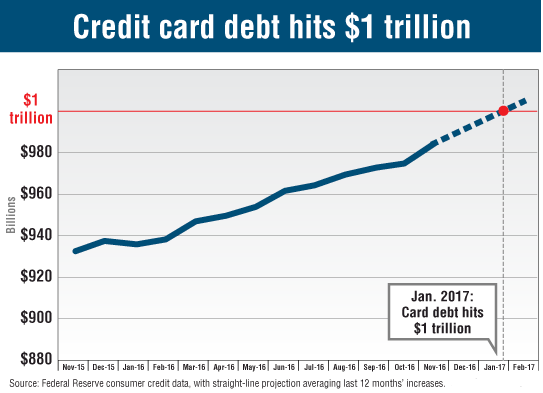

Credit card debt has passed 1 trillion

January 11, 2018Holiday debt piles onto already high credit card balances

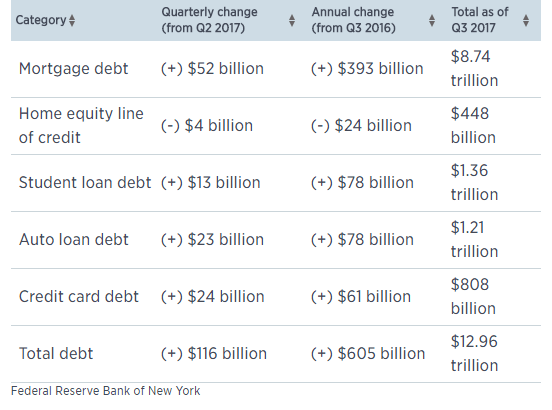

A study showed that the average consumer spent about $1054 this past Christmas on their holiday purchases. Which is about 5% more than they spent last year. Credit card debt right now is at an all time high, totaling $808 billion dollars almost to a trillion dollars.

With increased spending, it raises a couple of red flags. If consumers are able to continue to rack up debt, then the Federal Reserve usually steps in an starts raising the interest rates. When the Federal Reserve raises these interest rates, it means that all consumer date will see a rate hike. This includes, mortgages, credit cards, home equity lines, student loans, and auto loans.

It’s very important to keep track of these numbers because when a person places items on credit cards thinking they can pay it off in a few months, once these interest rates come into affect, it will increase their credit card balances.

A general rule of credit is keep credit cards only at 30% of utilization, to have a nice impact on your credit scores. Those who are over this percentage, see if you can open a new credit card with a balance transfer of 0% APR. The Chase Slate credit card is a decent card because there is no annual fee, and it gives you 15 months without interest when you transfer your balances.

Make sure that you pre-qualify because if you end up getting denied for the card, it will negatively affect your credit!