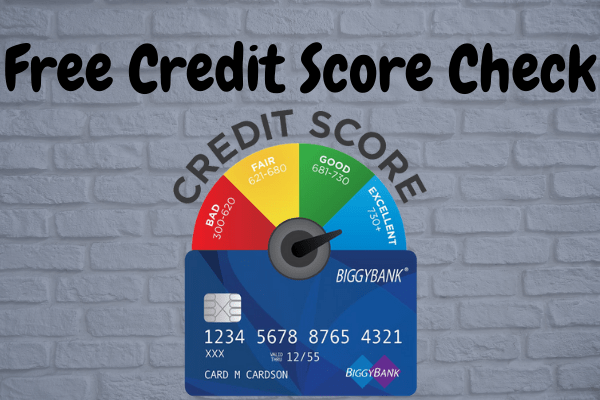

Many lenders and retailers who extend credit facilities use credit score. The main purpose is to eliminate bad debts or any such poor line that may involve in the transaction. If you have bad credit score the lender may refrain from extending credit facilities but person with good credit score does not face any financial shortage. If you desire to have good credit score or want to increase credit score scale then you must check your credit score periodically. It is always advisable to check your credit score once in six months. Remember a minor error in your credit score can cause major destruction in your credit score rating.

Credit Scoring: Advantage

Your credit score reflects your past payment and debts history. Because of this credit score and reports many financial institutions are able to lend “instant credit” to the borrowers. Now days if you intend to purchase a car or house on credit the prospective seller ask for your credit score. That indicates that your credit extension is totally based on your credit score scale.

Your credit score consists of 5 components, which are payment history (35%), types of credit used (10%), Credit Inquiries (10%), total amount owed (30%) and length of past credit History (15%). It also reflects your bankruptcy, divorces, judgement, lien as well as all the negative and positive remarks. In order to avoid such things you must make your payment on time or before the due date. Here you can check the free credit score online..