Enough Is Never Enough: Americans Weigh In on How to Help Those Struggling Financially During Pandemic

Enough Is Never Enough: Americans Weigh In on How to Help Those Struggling Financially During Pandemic

The new normal is nowhere.

The pandemic with its stay-at-home orders resulted to skyrocketing cases of unemployment as businesses and organizations had a hard time coping with the dramatic changes.

There was a recent survey wherein 3,000 Americans were asked to share their thoughts on the ways that they can do to help people who might be facing financial struggles amidst the COVID-19 pandemic. The results of the survey revealed the following about how to help those struggling financially during the pandemic:

Americans Agreed to Offer Assistance to People Who Suffered from Income Loss

About 68% of the respondents agreed with the statement that there are still a lot of things that can be done to assist those who lost their income because of the pandemic. Around 70% of those who responded yes were women and 66% were men.

However, the solution is not always easy and simple as far as the financial aid for the millions of Americans are concerned. How will a country make sure that all of its citizens will be properly taken care of in such a way that will make fiscal sense? Will the individuals carry the burden of making personal contributions?

The respondents were also asked if they are ready to willingly donate their second stimulus, if ever it is issued, to others who lost their income because of the pandemic.

Donation of the Second Stimulus Check Won’t Solve the Problem

Even though most of the respondents agreed that Americans can use more financial assistance now more than ever, about 67% of them wouldn’t consider donating the second stimulus check that they might receive to people who lost their income.

It is probably because COVID-19 made most Americans already financially strapped, whether it is because of reduced wages, furloughs, unemployment, as well as other factors.

But, it is worthy to note that even though Americans are not ready to give away their second stimulus checks as donation, the survey didn’t necessarily confirm if they are even willing to donate in the first place. Smaller and more bite-sized donations will probably be more suitable considering the financial capacities of people today.

Physical and Financial Self-Care Should Come First

In spite of how uncertain times can be, the mere fact that there was an improvement in consumer credit or debit scores is a promising sign to those who want to make their financial health better.

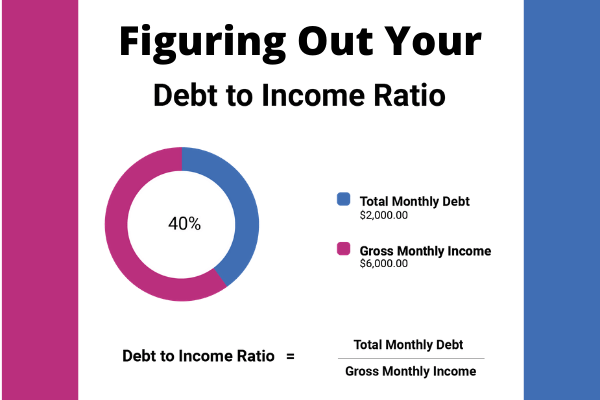

If you will revisit your budget right now, take note to prioritize paying your debts on time for your credit to stay healthy.

Never give up if you had a hard time making payments for the past few months or there was a temporary dip in your credit score. There is still a possibility of the approval of another stimulus check and whatever happens, you can still do things today to make your credit score better.

It is also important that you always monitor your report for any inaccurate or false items. If combined with financial struggles, these can easily ruin your credit score.