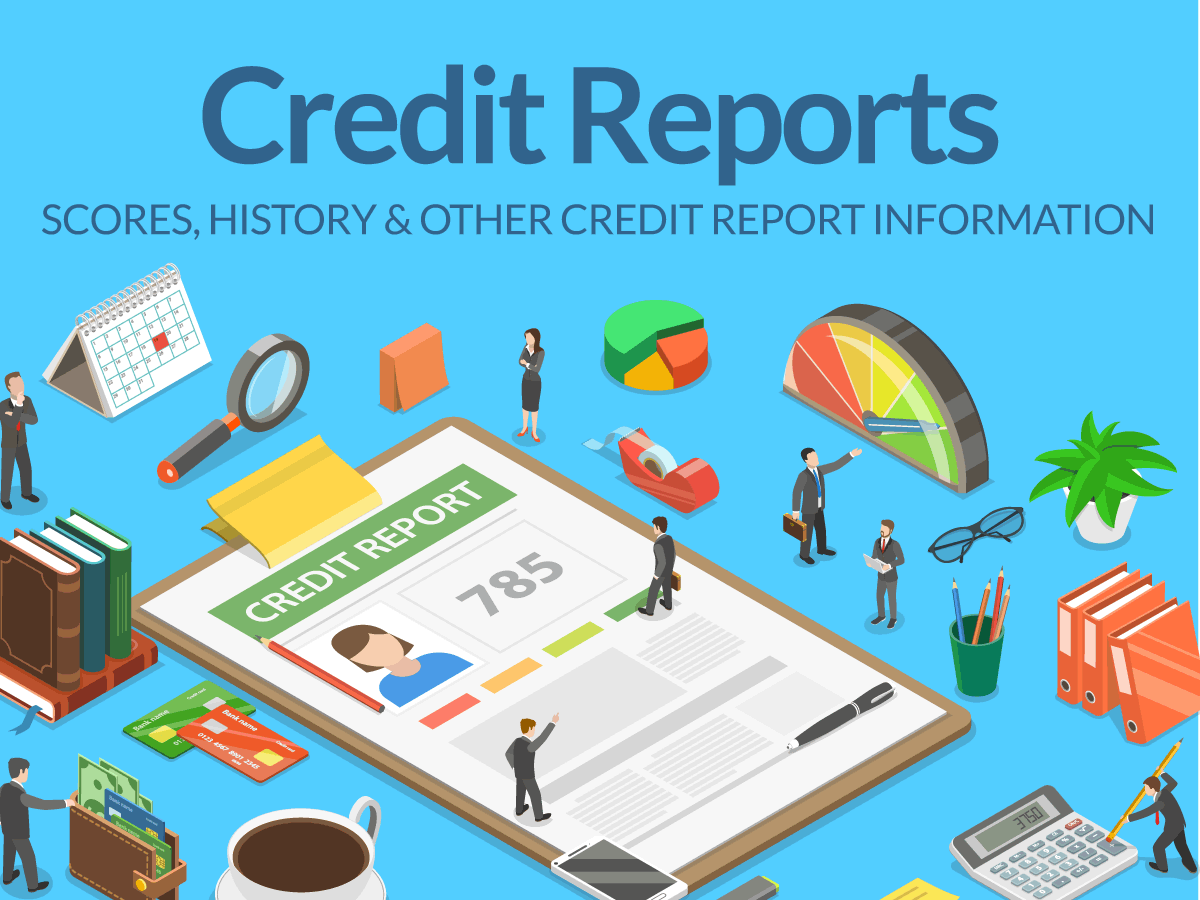

A credit report also comes with a credit score – FICO score – that can range between 300 to 850. This comparative score shows in a nutshell where a consumer stands with respect to others in the overall soundness of his or her credit history.

The credit score, like the credit report, can be used by a prospective creditor or finance company to instantly judge and sanction a service. A high score may get you a low interest rate and save valuable money, whereas a very low score may even result in a denial of service.

There are three major credit bureaus that collect information from other companies about consumer credit history and provide a return feedback on any prospective client.

It is important to know whether your credit report contains any mistakes, errors, and adverse comments against your financial activities. Everyone is entitle to obtain a free credit report from any of the major credit bureaus, and one should go for the same.

That’s all about managing your credit history. For more information visit: free credit report