What Is Credit Denial And What Can You Do About It?

What is Credit Counseling All About?

April 19, 2017

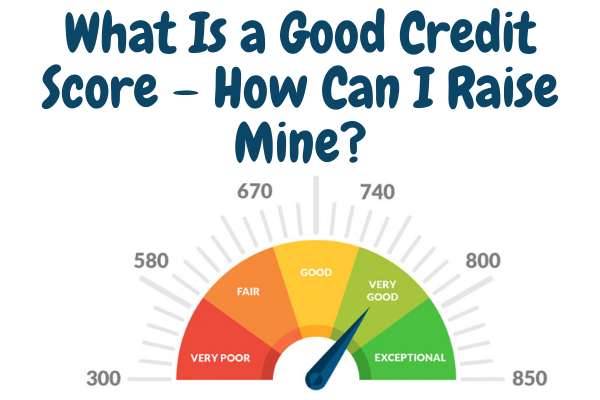

What Is a Good Credit Score – How Can I Raise Mine?

April 19, 2017What Is Credit Denial And What Can You Do About It?

What Is Credit Denial And What Can You Do About It?

If you apply for a credit card or a loan and the company turns you down, they must send you a written notice within 30 days.

You must be informed in writing why credit denial occur?. If the letter you receive doesn’t say why you were denied, it must tell you of your right to be given the specific reasons for denial if you request it. You should always request this information.

Why a Credit Denial?

The reasons they give for rejecting your application must be specific, such as, “Your income is too low,” “You have not been working long enough,” or “You didn’t receive enough points on our credit scoring system.”

General statements like, “You didn’t meet our standards,” are not enough. If they reviewed your credit report before making their decision, they must tell you the name of the credit reporting agency that gave them your credit report.

You are entitled to a free copy of your credit report

You have the right to get a free copy of your credit report within 60 days of being denied credit. Simply contact the credit reporting agency that provided the credit report and ask for a free report.

You can also get a Free Credit Report every 12 months.

Credit Scoring Systems

Loaning money is a risk. Most people pay their bills, but some don’t. Companies don’t want to give credit cards or loan money to people that are not likely to pay it back. To help them decide if you are a good credit risk or not, most companies use credit scoring systems. Credit scoring systems help them decide how likely you are to repay money you borrow from them or charge on a credit card.

When you apply for credit or a loan, the company will review your application and your credit report. They get your credit report from a credit reporting agency. Your credit report tells them your credit history. It tells them if you pay bills on time, or if you are normally late in making payments. It also tells them how much you owe on your house, your car, and other loans and credit cards you already have.

They take information about you from your application and credit report and feed it into a computer program. The computer program takes this information and outputs a credit score. Your credit score helps them decide whether to grant or deny you credit.

One of the most commonly used scores is your FICO score. The higher your FICO score, the better the loan you can get. You can use this calculator to find out the interest rate you qualify for. If your FICO score is low, you can learn how to improve your score.

Information that can and cannot be considered in your credit score

When you apply for a credit card or a loan, they can consider your income, expenses, debts, and credit history, but cannot consider your sex, race, national origin, religion, or age, unless you are less than 18 years old.

They must count as income any money that comes from full or part time employment, public assistance, child support, alimony, pensions, annuities or retirement. They cannot deny credit because of the source of your income.

If you are married and share an account, the companies that report your account information to a credit reporting agency must report both of your names. This will enable each of you to build separate credit histories.

Things to do if you were denied credit

To get a better understanding of why you were denied credit, speak to someone in the credit department at the company that denied you credit. You should also speak with them if credit was approved, but at a higher interest rate than you wanted. Ask them if a credit scoring system was used. If so, ask them what factors caused you to be denied credit or to be given credit on worse terms than you wanted. Ask them the best ways to improve your application.

If you were denied because of incorrect information in your credit report, get your credit report and dispute the errors that are in it. Review your credit report and correct errors.

If you were denied because you have too many credit cards or too much outstanding debt, you can reapply after paying down your balances or closing some accounts.

Your credit profile is always changing

You’re in control of your credit. Your credit gets better when you pay bills on time, pay down accounts, and reduce the number of credit cards you have, or increase your income. As your credit improves, companies will be more willing to give you credit at good interest rates.