Length of Credit History Explained

Late Payments and Why You Should Avoid Them

March 11, 2021

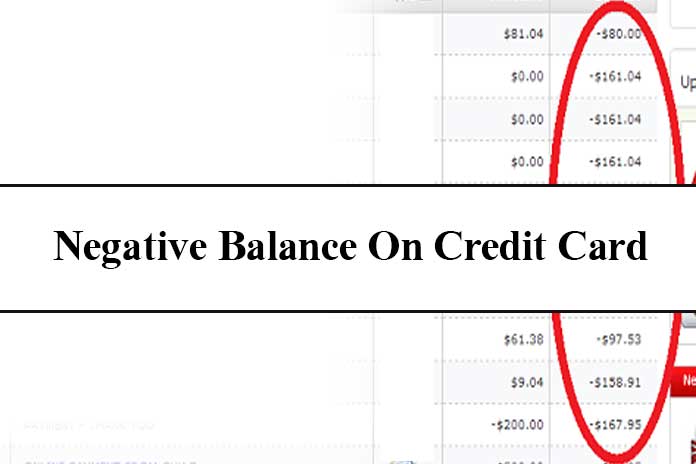

Negative Balance on Credit Card

March 11, 2021Most of you already know that making on-time payments on your student and auto loan, mortgage loan, and credit card can help improve your 3-digit FICO score. Of course, you are surely aware that the same thing happens if you stick to a low credit card debt. But, how many of you know that your length of credit history also affects your credit score?

What is Length of Credit History?

It is better for your credit score if you have a longer credit history. This is because lenders find it more comfortable to deal with borrowers with long history of on-time bill payments. Customers with short credit history are not yet able to prove or show that they could be trusted to make on-time payments in the long run. An established credit history is considered as one of the best ways of improving your credit score.

Lenders feel more at ease when dealing with consumers who have no missed payments with long credit history. Their credit scores are also better, another positive thing that can make lenders even more willing and open to loan them the money they need for personal loans, student loans, auto loans, and mortgages.

Your account can help improve your overall credit score if it is active and open for a long time. It doesn’t only show your ability to maintain credit as it also shows your patterns as a borrower over time.

This is the reason why it is recommended that not to close your old credit card accounts after paying them off with no plans to use them again. For starters, this can affect your credit utilization ratio. You will see an improvement in your credit score if you use your available credit less. The moment you close your credit card account, it automatically lowers your available credit amount. Your credit utilization ratio will still be hurt even when you don’t incur new debt.

Your length of credit history will suffer as well if you close an account after you open a new card. This is because you are getting rid of your existing older credit line to replace it with a newer one. It automatically lowers your credit accounts’ average age.

Avoid closing the account even after deciding that you don’t want to spend on that card any longer. Keeping the account open can help establish your credit history and maintain or improve your credit utilization ratio.

How to Calculate Length of Credit History?

There are three parts that make up your length of credit history. The first part is the length of time that each of the accounts you have has been opened. The second part is the length of time that the specific types of accounts have remained opened. These accounts can be installments like a mortgage or car loans or revolving like credit cards. The third factor is how long since you have used the accounts. It will not be of any help to your credit score if it has been 6 years since you last used your credit card.