How Long Before a Creditor Can Garnish Wages?

How Does Experian Boost Work?

March 6, 2021

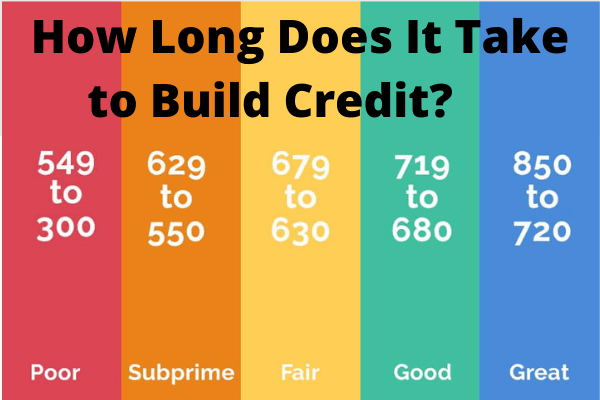

How Long Does It Take to Build Credit?

March 6, 2021How Long Before a Creditor Can Garnish Wages?

How Long Before a Creditor Can Garnish Wages?

Life sometimes gets so unexpected and before you know it, you find yourself in the midst of a mind-boggling financial hurdle. As you try to plow through every month, earning as much money as you can, you only end up realizing that your paycheck is simply never enough.

As months pass and you are bombarded with nonstop calls from your creditors, it feels like it is nothing but an endless cycle. Before you know it, you are surrounded by constant threats of lawsuits and wage garnishment that you just feel so lost. If you want to steady yourself and control your debt better, it might be best to make yourself familiar with wage garnishment.

Wage Garnishment – A Quick Definition

The easiest way to understand what wage garnishment is all about is to consider it as just the same as personal income tax withholding. Every paycheck, the employer withholds a certain portion of the pay of the employee to allot to their annual personal income tax. The concept of wage garnishment is similar wherein a court order requires an employer to withhold a certain percentage of the earnings of the employee.

Garnishment has two primary categories and these are the following:

- Wage Garnishment

Here, the employer withholds a specific cash amount from the earnings of the employee after a Notice of Garnishment is issued.

- Non-Wage Garnishment

Non-wage garnishment or also known as bank levy occurs if a lender receives a legal order for direct access to the funds in the bank account of the borrower.

How Can Garnishment Take Place?

Once a borrower defaults on the loan or any other financial obligations, the lender may file a suit against them for nonpayment. Provided that the case has enough support in the form of physical evidence, it is likely that the verdict of the judge will be in the creditor’s favor. In the event of nonpayment on child support, federal student loans, and back taxes, a garnishment can be initiated by a state or federal agency.

It is a must to note that wage garnishment will also include extra fees such as the debt’s accrued interest and court costs. This is why you can expect paying more than your initial borrowed amount from the creditor through the process of garnishment.

Garnishment Doesn’t Occur Immediately

Once a person defaults on a private debt, which means that they stop to make payments, the lender typically waits for 3 to 4 months before they deal with a debt. Once this period is over, most lenders are going to send the remaining debt to the debt collector.

Typically, the debt collector will try collecting the remaining debt for one year. This means that from that time a person has missed the first payment to the time the debt collector tries collecting on the debt, everything will take around 16 months. Following this timeframe, the debt collector might send the debt to a lawyer in order to take civil action. We are hoping that you understand all about How long a creditor can garnish wages.