How to Raise Your Credit Limits

Why you should pay debt before investing

February 8, 2018When to consolidate Federal Student Loans

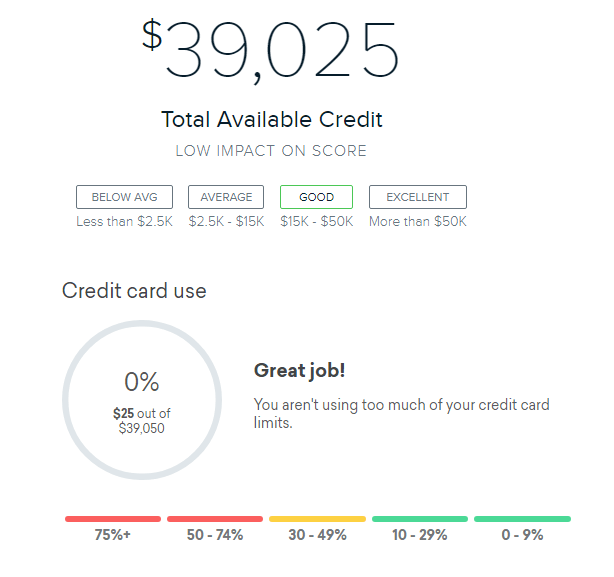

March 18, 2018Raise your credit limits: 30% of your FICO Score relies on the amounts that you owe. As illustrated with the screenshot above, you can see that:

- 0-9% Utilization is Excellent

- 10-29% Utilization is Above Average

- 30-49% Utilization is Average

Here’s something that a lot of people don’t know. You can request your credit card companies to raise your limit every six months, and they usually will increase it, without a hard inquiry!

Tips to raise your credit limits:

- If they ask how much you earn annually, double the actual number

- If they ask how many assets do you have, double the actual number

Why? Creditors will only raise your credit limits if have a good idea that they can sue you and actually recover all or some of the money they lent.

Creditors can’t actually see how much you earn, unless they ask for proof like when you purchase a home or buy a car. Creditors use these numbers as a basis to lending money, it’s ideal to take advantage ways in which there is little to no verification of the facts. Read this helpful article about 0% Interest Credit Cards – Fact or Fiction