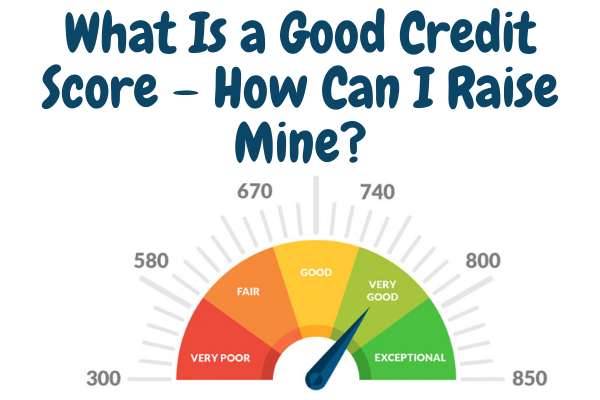

Using the mortgage industry as an example, if you ask what is a good credit score, the answer will be close to 650. If you are a lot lower than that, your chances of getting a loan to buy a house may be slim. If you ask about improving your credit score, then you will find that counsellors will tell you to pay your bills on time and try to pay them off. The less bills you have, the greater your chances of getting the loan you want.

You might not realize it, but applying too often for credit does affect your credit score. Your credit report contains the names of all the people who have requested your credit report, so having a long list of names in this section will not help you improve your credit score. Most consumers have the idea that when they ask what is a good credit score, they will find out that a lower number is better. You might also find that your score with one credit bureau is better than another depending on the creditors that deal with each one.

Moving many times also affects your credit score. Even though you pay your bills on time and are able to manage another loan, you may have to ask yourself how can I raise my credit score. When creditors see a lot of addresses, they assume you have trouble paying the rent. When you ask what is a good credit score, you also need to ask what factors affect the credit score. When you scan the credit report to see what your credit score is, you also need to look at all the bills and the number of times you were late with the payments. The next time you request a credit report, you will be anxious to see the score and you won’t have to ask what is a good credit score.

What is a good credit score? It’s all relative, but contrary to popular belief it is not “the lower the better”.