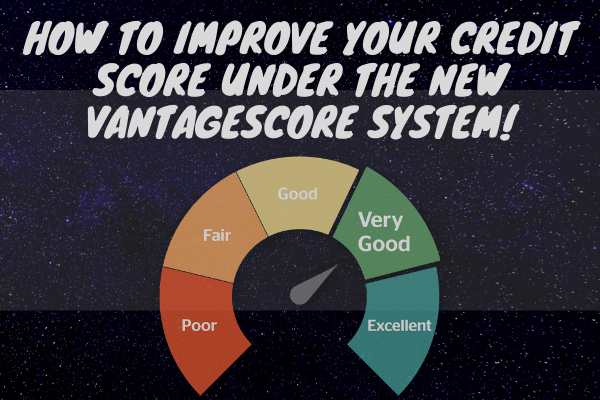

The new VantageScore system is supposed to create a more uniform method of determining credit risk. It combines new technology and the expertise of industry leaders on credit data to get an easier to understand and more consistent score for use by merchants and consumers alike. The score will be more like academic grading and range from 901-990 for the best credit and 501-600 for the worst.

The best thing about the new scores is that if you have little or no credit history, you can still get a decent score. To improve you VantageScore, always pay your bills on time. The payment history section of your credit report is an important factor in your VantageScore. So be sure that you do not take on more debt than you can handle

Also try to pay more than the minimum balance on credit cards and loan balances. Doing so will keep the principle down and prevent you from maxing out a card or defaulting on a loan. Even five or ten dollars extra per month can make a big difference down the line.

And check your credit report at least once a year for errors. You are eligible for a free report from all three agencies once per every twelve months. You would be surprised at how many errors there can be on your report. So get the facts straight so your VantageScore will be based on accurate information about you and your spending habits.

Here you can read How To Maintain Good Credit.